Cybersecurity Insurance: Protect Your US Business from Cyber Threats

Cybersecurity insurance is critical for protecting US businesses from financial losses resulting from cyberattacks, data breaches, and other digital threats, offering coverage for recovery costs, legal fees, and business interruption losses.

In today’s digital landscape, US businesses face an ever-growing threat of cyberattacks. Understanding the importance of cybersecurity is no longer enough; businesses need robust protection against the financial fallout of data breaches and cybercrimes. This is where cybersecurity insurance: protecting US businesses from financial losses comes into play, offering a critical safety net for navigating the complex world of digital risks.

Understanding Cybersecurity Insurance for US Businesses

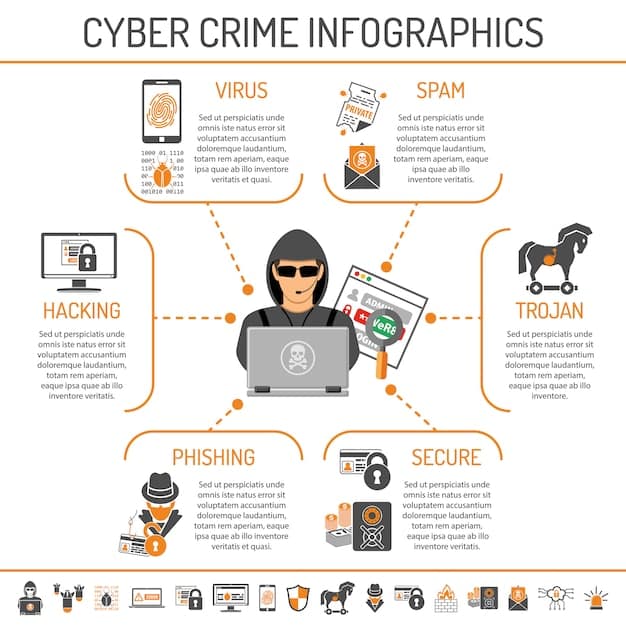

Cybersecurity insurance, also known as cyber insurance or cyber liability insurance, is a specialized insurance policy designed to protect businesses from the financial losses associated with cyberattacks and data breaches. It helps cover the costs of recovering from a cyber incident, including legal fees, notification expenses, and business interruption losses. In the US, where cybercrime is rampant, this insurance is becoming increasingly essential for businesses of all sizes.

The rise of sophisticated cyber threats has made traditional insurance policies inadequate for covering digital risks. Cybersecurity insurance addresses this gap by providing comprehensive coverage tailored to the specific needs of businesses operating in the digital age.

Key Benefits of Cybersecurity Insurance

Investing in cybersecurity insurance offers a multitude of benefits for US businesses, providing financial protection and peace of mind in the face of cyber threats. From covering legal costs to mitigating business interruption losses, here are some key advantages:

Financial Protection

One of the primary benefits of cybersecurity insurance is the financial protection it offers. Cyberattacks can be incredibly costly, with expenses ranging from data recovery and system repairs to legal settlements and regulatory fines. Insurance helps cover these costs, preventing businesses from suffering significant financial losses that could threaten their survival.

Legal and Regulatory Compliance

Data breaches often trigger legal and regulatory obligations, such as notifying affected customers and complying with data privacy laws like the California Consumer Privacy Act (CCPA). Cybersecurity insurance can help cover the costs associated with these obligations, including legal defense fees, settlement expenses, and regulatory penalties.

- Covers legal defense costs and settlements

- Helps comply with data privacy laws

- Provides access to legal expertise after a breach

In summary, cybersecurity insurance offers vital financial protection against the high costs associated with cyber incidents and helps businesses navigate the complex legal and regulatory landscape following a data breach.

Types of Coverage Offered by Cybersecurity Insurance

Cybersecurity insurance policies typically offer a range of coverage options to address different types of cyber risks. These can include coverage for data breaches, business interruption, cyber extortion, and more. Understanding the different types of coverage available is crucial for selecting a policy that meets your business’s specific needs.

Different forms of coverage address different problems arising from cybercrime. Policies may have different limits or coverages, which should be considered when choosing a course of action.

Data Breach Coverage

This type of coverage helps cover the costs associated with responding to a data breach, including forensic investigations, customer notification expenses, credit monitoring services, and public relations efforts to mitigate reputational damage.

Business Interruption Coverage

Cyberattacks can disrupt business operations, leading to lost revenue and productivity. Business interruption coverage helps replace lost income and cover additional expenses incurred as a result of a cyber incident, such as the cost of hiring temporary staff or relocating operations.

- Lost revenue during system downtime

- Extra expenses to maintain operations

- Coverage can restore you to pre-incident circumstances.

In conclusion, knowing the types of coverages available allows you to choose which are best suited for your business needs, insuring that you are only paying for the coverages applicable to you.

Factors Affecting Cybersecurity Insurance Premiums

The cost of cybersecurity insurance varies depending on several factors, including the size and type of business, the industry in which it operates, its cybersecurity posture, and the coverage limits and deductibles selected. Insurers assess these factors to determine the level of risk associated with insuring a particular business.

Premiums consider the chance of a cyberattack or breach and the potential cost of damages. By accounting for these variables, insurers can adapt premiums to the risks.

Business Size and Industry

Larger businesses and those operating in high-risk industries, such as healthcare and finance, typically pay higher premiums due to the greater potential for significant financial losses in the event of a cyberattack. These organizations often handle sensitive data and are attractive targets for cybercriminals.

Cybersecurity Posture

Businesses with strong cybersecurity measures in place, such as robust firewalls, intrusion detection systems, and employee training programs, may qualify for lower premiums. Insurers view these businesses as less likely to experience a cyber incident, making them a lower risk to insure.

Coverage Limits and Deductibles

The coverage limits and deductibles selected also impact premiums. Higher coverage limits provide greater financial protection but come with higher premiums. Conversely, higher deductibles lower premiums but require businesses to pay more out-of-pocket in the event of a claim.

In summary, balancing coverage and costs is essential. By thoughtfully addressing risk variables, you can navigate the path to both adequate coverage and affordable premiums.

Choosing the Right Cybersecurity Insurance Policy

Selecting the right cybersecurity insurance policy requires careful consideration of your business’s specific needs and risk profile. Evaluating different insurers, comparing coverage options, and understanding policy exclusions are essential steps in the selection process. It may also be wise to consult with an expert.

A suitable policy is one that protects against the unique dangers to your business. Customization is essential to guarantee that your insurance meets ever-evolving demands.

Assess Your Business’s Risks

Start by assessing your business’s cybersecurity risks. Identify the types of cyber threats that pose the greatest risk to your organization, such as ransomware attacks, phishing scams, or data breaches. Consider the potential financial impact of these threats and the costs associated with responding to a cyber incident.

Evaluate Different Insurers

Research and evaluate different cybersecurity insurance providers. Look for insurers with a strong reputation, experience in the cyber insurance market, and a proven track record of handling cyber claims. Consider the insurer’s financial stability and its ability to provide timely and effective support in the event of a cyber incident.

Review policy exclusions

- Examine the policy for any exclusions that may limit coverage

- Ensure that the insurance addresses the most important aspects of your firms risks.

- Understand exclusions by seeking clarification from the insurer

Finally, compare your company’s specific requirements to the insurance policies and coverages available to secure your business.

Steps to Take After a Cyber Incident

Even with cybersecurity insurance in place, it’s essential to have a plan for responding to a cyber incident. Prompt action can help minimize the damage and ensure a smooth recovery. This includes notifying your insurance provider, conducting a forensic investigation, and implementing incident response measures.

A well-thought-out response plan guarantees that you can take immediate action to reduce the effect and begin recovery. Quick action is essential.

Notify Your Insurance Provider

As soon as you become aware of a cyber incident, notify your cybersecurity insurance provider. Provide them with all relevant information, including the date and time of the incident, the nature of the attack, and the potential impact on your business. Your insurer will guide you through the claims process and provide access to resources and expertise.

Conduct a Forensic Investigation

Engage a qualified cybersecurity firm to conduct a forensic investigation of the incident. This investigation will help determine the cause and scope of the attack, identify any vulnerabilities that need to be addressed, and gather evidence for potential legal or regulatory action. Information can be shared with law enforcement.

Implement Incident Response Measures

Implement your incident response plan to contain the damage and restore normal operations. This may involve isolating affected systems, resetting passwords, patching vulnerabilities, and notifying affected customers or stakeholders. Take steps to prevent future incidents, such as enhancing security measures and providing additional employee training.

In conclusion, when you take rapid action following a cyber incident, you’ll hasten damages and make the recovery process easier.

| Key Point | Brief Description |

|---|---|

| 🛡️ Financial Protection | Covers costs like data recovery, legal fees, and business interruption. |

| ⚖️ Legal Compliance | Helps manage legal obligations after a data breach, including settlements and fines. |

| 📊 Policy Factors | Premiums depend on business size, industry, cybersecurity measures, and coverage limits. |

| 🚨 Incident Response | Includes notifying insurers, forensic investigations, and incident response measures. |

Frequently Asked Questions About Cybersecurity Insurance

▼

Cybersecurity insurance protects businesses from financial losses due to cyberattacks, covering costs like data recovery, legal fees, and business interruption. It’s essential for businesses facing increasing cyber threats.

▼

Cybersecurity insurance typically covers various cyber threats, including data breaches, ransomware attacks, phishing scams, and denial-of-service attacks. Policies may vary, so review coverage details.

▼

Premiums are determined by factors such as business size, industry, cybersecurity measures, and coverage limits. Businesses with strong security practices may qualify for lower rates.

▼

Immediately notify your insurance provider, conduct a forensic investigation to determine the cause and scope, and implement your incident response plan to contain the damage.

▼

Assess your business’s risks, evaluate different insurers, compare coverage options, and understand policy exclusions. Consider consulting with a cybersecurity insurance expert for guidance.

Conclusion

In conclusion, cybersecurity insurance: protecting US businesses from financial losses is a vital tool for mitigating the financial impact of cyber threats. As cyberattacks become increasingly sophisticated and prevalent, businesses must prioritize cybersecurity and invest in comprehensive insurance coverage to safeguard their operations and assets.